1. The Mission…

QUALITY > QUANTITY

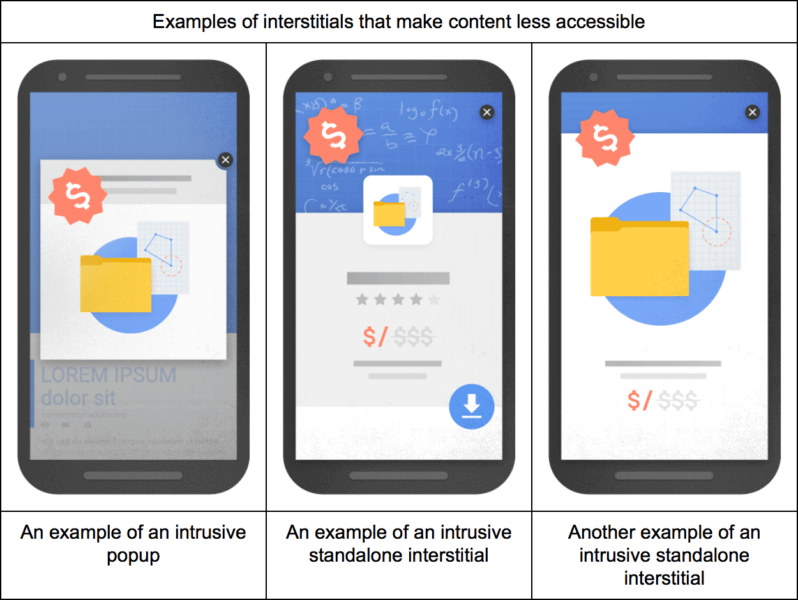

Unlike any other conference in digital history, the Automotive Engagement Conference began as a collective mission to expose all digital entities guilty of not delivering QUALITY, measurable solutions to dealers. It all began as a dream, or more so, it began when industry leaders started waking up to a big problem. Study after study found evidence of dealerships paying for website traffic that consisted of BOTS – not humans – not actual people that were capable of purchasing a car, let alone converting into a showroom visit. The unfortunate reality is all too often digital advertising sources are charging dealers big bucks for clicks and impressions that did not engage with their website or the content and lead forms within it.

Orbee, an automotive software company that specializes in identifying bad website traffic, determined up to 60% of dealerships’ paid traffic, and up to 80% of their overall website traffic is coming from non-humans (or bots). Furthermore, Orbee’s late 2016 Automotive Website Traffic Quality Report stated, “Bot traffic is a $7 billion problem for the advertising industry and with dealership digital marketing budgets averaging $30-50K per month, the automotive industry must address this issue to prevent massive waste in digital adverting spend.”

Last year, Brian Pasch, host of the AEC Tour, began the PCG Engagement Project in efforts to measure the quality of traffic coming to dealer websites. “Once dealership managers understand the impact of not measuring engagement – their advertising blind spot — they will act to get their website(s) configured to start tracking engagement,” said Pasch.

Pasch’s mission to expose these “sharks” along with the rate of waste occurring under the radar was something AutoHook ethically HAD to get involved with. The AEC Tour isn’t your ordinary pay-to-play conference where vendors spend thousands of dollars just to get their product in front of dealers around the country. This is a movement. This is a collective mission to hold ALL automotive agencies and vendors accountable for providing their dealer clients with accurate reporting that shows their solutions deliver actual human traffic, capable of converting into a sale.

2. The Experts…

PCG has hand-picked the companies and presenters listed below because of the simple fact that their solutions are all proven to increase consumer engagement, and most importantly, increase sales from all lead opportunities.

LEARN FROM AWARD-WINNING AUTOMOTIVE MAR-TECH EXPERTS

3. The Content…

Dealers will learn proven methods to:

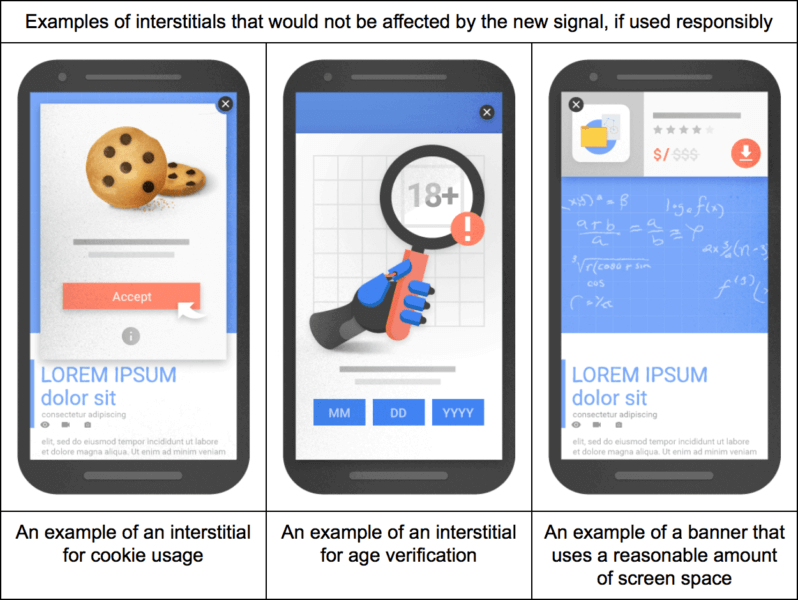

Accurately measure their website’s engagement metrics to further increase conversion rates and ELIMINATE areas of waste in their marketing spend.

- Leverage marketing automation tools to create relevant advertising optimized by consumer engagement.

- Improve their online communications strategies to increase conversions: leads, calls, chats, and text messages.

- Lead their dealership in a digital age and protect your store from Digital Sharks!

AutoHook President, David Metter, will be presenting:

“99 Problems but the Data Ain’t 1” – Check out the teaser video below.

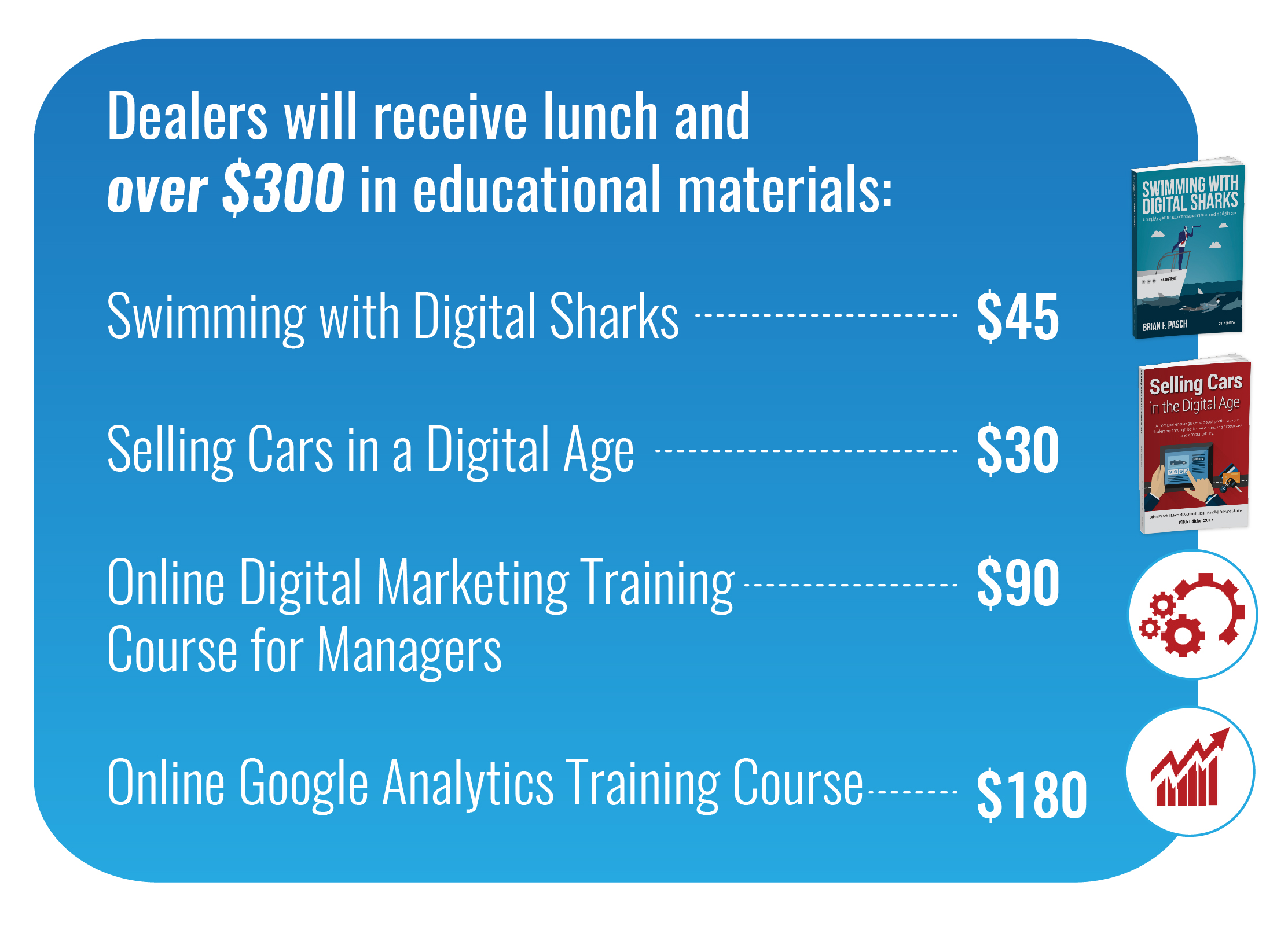

4. The Value…

+ $300 WORTH IN MATERIALS

+ AWESOME SWAG BAGS AND FREE PRIZES!

5. AutoHook Will Cover Half Your Ticket…

Tickets for the event cost only $50. Have you ever attended a conference for just $50? When you visit AutoHook at a city near you, we’ll reimburse you for half your ticket cost with a $25 Visa Card.

ATLANTA MARCH, 23RD

DETROIT APRIL, 6TH

TYSONS CORNER, VA APRIL, 20TH

DALLAS APRIL, 25TH

NEW JERSEY MAY, 9TH

LOS ANGELES MAY, 11TH

CHICAGO JUNE 1ST

Want more information on how to eliminate bot traffic? Check out David Metter’s latest articles… BOTS EXPOSED: Defining & Uncovering Your Wasted Ad Spend or The Dark Truth About Bot Traffic.