If Your CRM Could Talk…How to Expose Your “True” Top Salespeople

| by David Metter

One of the only remaining constants in the car business is an overwhelming surplus of opinions. Unfortunately for Dealers, it’s almost impossible to silence the constant stream of opinion being pitched in their direction at all times – unless, of course, they choose to operate based on what they know. The beautiful thing about science is that it turns the volume of opinion down so much we can no longer hear its intrusive racket. What we’ve come to find is that the opinions within so many facets of a dealership’s sales process can be overpowered and replaced by science, ultimately resulting in Dealers selling more cars, operating more efficiently and employing better salespeople for a longer period of time.

Before we had the type of data we have now, we could look at all the opportunities in our CRM, whether they were Internet leads, phone calls or ups on the showroom floor, and do sales match on those opportunities using registration data. The problem with that however, is that registration data is 45 days old and CRM data can be one-dimensional. Meaning, we could see how many opportunities we lost and what they ended up buying, but we had no insight as to where they bought or which salesperson touched the opportunity before they walked out and bought from a competitor…until now.

What’s been fascinating to watch develop over the last couple of years is the ability we now have to look at data in different ways than we’ve ever have before – and one of those ways is at the salesperson level. In the past, salespeople have been judged solely by how many sales they closed out of the opportunities they had in the CRM. So essentially, we could see their closing ratio under a one-dimensional view. But we couldn’t see what they were losing. Today on the other hand, due to innovations in what we can do with a Dealer’s CRM data, we get a much more accurate, three-dimensional view of how our salespeople are truly performing based on the complete picture.

We know not just how many cars each of our people sold, but how many leads they touched that walked out and bought from a competing dealership. And we know if those defections bought from a dealer within the same brand or a competitive brand. We can also dig even deeper into the quality of the leads they’re working to gauge the true performance of your lead providers. Couple that with the performance of your salespeople, and that’s when data viewed through a scientific lens becomes incredibly powerful and prescriptive. That’s when you can start making improvements and executing more efficiently based on what you know, rather than opinion.

When a great salesperson’s defections are almost pacing what they sold, Dealers can see right away when one of their “best” salespeople is actually losing way more than they’re winning, or burning through opportunities. By layering in this defection data on top of the sales data, you can see the true success and failure of each individual player on your team. CRM data is so important, but it’s not three-dimensional in the sense that you can’t see lost opportunities or defections on top of closed sales. Having this information gives you the actual true effectiveness of each one of your salespeople.

Additionally, if one salesperson has significantly fewer opportunities but closes more sales than they lose, that all plays into the overall methodology of how effective they are. It’s just like in baseball when you have a 300 hitter, but he only gets 100 at-bats. He’s not getting regular daily playing time – but this guy is a 300 hitter! So, he should be getting more opportunities up at the plate. Same thing applies to salespeople that deserve to get more opportunities based on their true performance.

We can also track their performance or “batting average” over time to see if it improves or declines. Or, you can test to see if an individual’s batting average changes based on the number of opportunities assigned to them. Whether it does or it doesn’t, the important thing is we now have the necessary information to diagnose where our blind spots are along with a science-based prescription on how to operate more efficiently. Oh – and the best part? Dealers can rest easy knowing they can make decisions and take immediate action based on fact alone.

SPECIAL GUEST BLOG: When Knowing What You Don't Know Slays The Marketing Dragon

Stop focusing on the data that everyone else has and try to find insights using new data sources

BY STEVE WHITE | CEO & FOUNDER, CLARIVOY

A massive amount of data is now available on every potential car buyer, with a multitude of ways to use it. And, when it comes to targeting your audience, most ad platforms try to make it easier for you. The thought process is usually something along the lines of, the more detailed you are in your targeting, the more likely that your ads, messages, video, etc., will be shown to the right people – or at least for the most part.

But what about what you don’t know?

I recently read an interesting article on Business2Community which had me thinking about this very point. According to the article, there are four types of data: Facts we know, information we don’t have but know how to find, gut feeling, and things we don’t know we don’t know.

I love the last one because it makes sense and made me start to wonder how exactly DO we get information that we aren’t even looking for? Maybe we simply don’t know to look for it because nobody ever has. Perhaps we don’t look for it because, on the surface, it appears irrelevant. The trick, however, is this: all your competitors are attempting to target people utilizing the first two types of data – things we know (demographics, location, etc.) and information we don’t have but know how to find (such as targeting through AdWords, Facebook, etc.)

If everyone else is doing the same thing, targeting in similar ways and then sitting back in their chairs high-fiving themselves, what does that mean for the customer? It means that, while everyone is congratulating themselves about how great their marketing is, the customer is bombarded with noise from all these sources. While the intent of these sources may be to be relevant, when bombarded and over-saturated with messages, the customer reacts to everyone’s message as if it is irrelevant and just more noise.

Think about it, what would happen if you visited a website and each ad was for the same product or service, the only difference being that each ad was from different companies? You’d quickly ignore them all. Even if they’re relevant.

Perhaps then, a better strategy would be to stop focusing on the data that everyone else has and try to find insights using the other type of data: things we don’t know we don’t know. According to the article, this can help you discover things about your audience that your competitor doesn’t know. Then you gain an advantage both in ad delivery and marketing spend. Why? Because if you dig deep through your data to find trends and commonalities that you aren’t used to looking for, you’d be able to bid less for display and paid search, simply because there will be less people bidding against you.

So how do you find these insights? Using data you probably aren’t tracking right now. For example, let’s simplify it to data gathered from a website. The article suggests utilizing tools such as heat-mapping and text tracking widgets to really understand that the customer visited this or that page on your website and what they actually looked at, read or engaged with. Having this information can provide valuable insight and the opportunity to learn things about your customers that you never did before.

Start thinking outside-the-box and analyze data you may never have deemed important before. You could find yourself with a competitive marketing advantage and, at the end of the day, have more money left in the bank.

10 Key Takeaways from the DrivingSales Data Discussion of 2017

by David Metter

I recently had the honor of co-moderating a dealer panel discussion at the DrivingSales Executive Summit. Together with fellow attribution frontrunner, Steve White, CEO & Founder of Clarivoy, and our dealer experts, Shaun Kniffin, Marketing & Technology Director of Germain Automotive Group and Ben Robertaccio, Marketing Director of the quickly-rising Morrie’s Automotive Group, we we’re fortunate to have a jam-packed room on the last day of the conference. I guess the panel title (or the speaker lineup) evoked some attention…

For anyone that missed it, I’ve compiled a list below of the top ten takeaways from THE DATA DOESN’T LIE: Shocking Discoveries in Automotive Attribution.

1. Sales Attribution > Traffic Attribution

As an industry, we need to entirely shift away from traffic attribution models and really zero-in on sales attribution – that’s where the good stuff is. Traffic attribution only gives you one slice of the pizza. It looks at the traffic that comes to your website and builds marketing strategies based on that alone. Roughly 75% of people that buy cars from you visit your website – so what are you doing to account for the other 25%? Traffic attribution doesn’t tie a sale to that site traffic, where sales attribution directly ties a car sold to the path that led to the sale. Furthermore, we have to factor in the reality that 71% of online users remain anonymous.

Ben Robertaccio, Marketing Director for Morrie’s Automotive Group says, “70% of people come into your dealership without first contacting you. Less than 10% contact you or convert through your website. If we don’t have data on the mass of our customer base, then we need to find better ways to understand them.”

2. There are WAY too many KPIs to realistically keep track of.

Shaun Kniffin, Marketing & Technology Director for Germain Automotive Group shared their recent initiative to define the most important KPIs that exist within all the profit centers of a dealership. “Together we identified 127 KPIs as the key ones to follow. In digital marketing alone, we identified 27 critical KPIs. Our GMs all agree that between 4-16 of those 27 digital KPIs should be looked at on a daily basis.” But how many of them actually do it? Dealers are reported to death. They’re inundated with data and it’s often impossible to know where to start without enlisting the right help.

3. In a perfect world, EVERYONE’S data would reside in CRM.

It would be in the best interest of CRM companies to take into consideration what has made Salesforce so successful and apply that same business model to automotive. For just a minute, take yourself out of our industry. Put yourself in ANY other industry and ALL of the data resides within Salesforce. There are plugins within Salesforce that collectively make it better, more powerful, and virtually indispensable. Salesforce grew exponentially when they opened up those opportunities to make corporations that use Salesforce better. We don’t see that in automotive and that’s a very frustrating thing, and it should be more frustrating to you as a dealer because you are required to live and breathe within CRM every single day.

AutoHook’s data, Clarivoy’s data, everyone’s data should reside in CRM. If we know the behavioral traits specific to the customers in our CRM, our salespeople can simply look at their screen (just like you would in Salesforce) and immediately see every digital destination that customer has passed through. That’s what our salespeople need in order to have much more meaningful, efficient conversations with their customers.

In a perfect world, there would be an independent 3rd party overseeing the validity of everyone’s data, as we know vendor reporting has the potential to be self-serving. But if we know we have clean, accurate data, then we as marketers can easily figure out how to help GMs make much better decisions with their budget.

4. Google Analytics is a great tool…IF it’s set up correctly.

Google Analytics has the potential to be a phenomenal tool, but it can also be complicated, involved and difficult to derive any real actionable insights from. How many GMs go into their GA dashboard every day? Not many. So how can we expect our managers to actually obtain any real value or insights from of GA alone?

Ben Robertaccio advises dealers to have their key goals and conversions set up properly in order to measure what’s actually happening - and that includes SRPs, VDPs, leads, chats, calls, texts, map views, etc. The best reports out there take GA data and feed in multiple other data sources to deliver a clear path towards correcting the flaws in your business.

A great tool is one that’s able to synthesize all the data and turn it into something dealers can actually use. Ben recommends AutoHook’s Traffic Conversion Analysis (TCA) powered by Urban Science data. “TCA feeds in CRM data, new vehicle registration data, our sales data, and what our competitors are selling, and it’s able to show me data like I’ve never seen it before. If we didn’t have TCA, we would have continued to spend, spend, spend, when it reality it was our process that was broken, and TCA was able to make that clear.”

5. There needs to be massive consolidation of analytics tools in the market space.

Because of the intertype competition amongst tiers and players within the automotive vertical, we need to get to the point where dealers can know (or at least have a solid benchmark) of how many cars each vendor will help them sell per month.

Shaun Kniffin reminds us of the ugly truth that, “This industry has more snake oil than any other industry,” and he’s right! Additionally, there aren’t any real standards or benchmarks to let dealers know how they are doing at any given point because of the fact that every dealer and every market is so different. We need to push for more open data sharing, partnerships, and standardization amongst vendors and at all industry levels.

Ben Robertaccio makes another great point when he says, “I see this operational divide across industries: operations vs. marketing. We see it in every industry. But what we need to do is foster an environment where I show you results, you show me results and we work together.”

6. 3rd party listing sites like Cars.com & Autotrader are NOT lead generators.

Leads aren’t everything. Clarivoy Founder & CEO, Steve White says, “Don’t ignore the cumulative effect of the journey that took place to produce that lead.” People don’t just go to Cars.com and submit their information – it’s not that simple. Autotrader, Cars.com, CarGurus all those sites are not lead sources. Their responsibility is to expose your inventory on a grand scale.

Shaun Kniffin happened to be the very first Cars.com customer in Columbus, OH back in 2001. He says, “I’ve never looked at Cars.com as a lead source. A lot of GMs don’t understand how many VDP views these sites generate for their stores each month - it’s more activity than your Search Engine Marketing could produce in an entire year. It’s our job as educators to bring them to the forefront and say let’s put this into perspective – how do you replace all these VDPs? And that’s all part of multitouch attribution. Exposing that inventory is the #1 job of Trader, Cars, Gurus, etc.”

7. Using Last Click Attribution is a lot like…

Clarivoy CEO & Founder, Steve White, made the incredible analogy of comparing attribution to a hangover. “It’s a lot like blaming a hangover on that last beer you had. But in reality, it wasn’t just that last beer, it was the cumulative effect of the 10 other drinks you had before that. So that’s what you have to think about from an attribution perspective. There is a cumulative effect to all of your different marketing touchpoints.” Making really big decisions based on last click is just not the smart thing to do.

8. Dealers suffer from A.D.D.

Which of course stands for, “Another Damn Dashboard.” Every vendor has their own dashboard. The last possible thing today’s dealers want is another report or system to log into. These dashboards have become nothing more than complex conundrums of numbers and statistics that lack meaning and more than anything, lack the ability to execute.

Kniffin says when it comes to their vendors, “I just want to know if you’re involved in the sale. I just want to know are you part of my math, are you part of my chemistry? Are you going to help me attribute more sales? As marketers all we want to know is how can we make these numbers better? How are you who manages my paid search going to make your numbers better and help us optimize our spend?”

9. Hold Your Vendors to a Higher Standard

Ben Robertaccio emphasizes, “We all need to hold our vendors and our partners to a higher standard to make sure they are feeding into our analytics appropriately and ensuring the data they provide us with is pure and valid. In a utopian world, all our vendors would work together openly and all agree on how to measure things.”

10. Don’t rely on your customers (or your CRM) to help with attribution.

If dealers were to ask their customers what their click path consisted of before coming in for a test drive, most people wouldn’t have a clue. The digital journey that takes place leading up to a sale is just that – a journey. It’s something that happens organically, over time, across devices, both at home and on the go.

Kniffin adds, “Single source attribution in CRM – THAT’S frustrating! We’ve challenged every one of the CRM companies out there, and it’s a crowded space, but the truth is, single source attribution does not help us develop a strong marketing strategy, period. And how much of that is really subjective data?”

Ben Robertaccio shares Kniffin’s frustration and follows it up with a good point, "Pretty regularly I don’t remember what I had for dinner the night before so how am I going to remember what traffic source influenced my purchase?”

Thanks to our friends at DealerRefresh, you can check out this panel discussion live from #DSES2017. Click here to watch The Data Doesn’t Lie: Shocking Discoveries in Automotive Attribution on Facebook Live.

AutoHook & Clarivoy Join Forces for the Most Action-Packed Dealer Panel of 2017

THE DATA DOESN’T LIE:

SHOCKING DISCOVERIES IN AUTOMOTIVE ATTRIBUTION

Co-Authored by David Metter of AutoHook powered by Urban Science, & Steve White of Clarivoy

An unprecedented occurrence has taken place as the automotive industry prepares for the upcoming DrivingSales Executive Summit, October 22nd - 24th, at the Bellagio in Las Vegas. Two vendors, two of the industry’s most recognized names in proving sales attribution, have combined forces with marketing leaders from the nation’s top dealer groups to deliver the most unbiased, action-packed panel discussion in auto conference history.

Before we reveal why this atypical panel lineup is worth attending, we first want to inform you of what this session is NOT going to be. This is NOT a reiteration of the importance of attribution when it comes to eliminating marketing waste. This is NOT a theoretical account of big data’s potential impact on improving your daily sales operations. This is a collaborative, all boots on the ground ATTACK on the two topics that have been plaguing dealerships for far too long: big data and attribution.

AutoHook Co-Founder & President, David Metter, and Clarivoy CEO & Founder, Steve White, will be co-moderating a dealer panel that will leave attendees with a multi-dimensional, crystal clear picture of how successful dealers are already using big data and advanced attribution models to do the only thing that matters to them: sell more cars.

Attendees will get a first-hand account from Marketing Directors at the nation’s leading dealer groups about how they are taking action and selling cars using data they already have available combined with technology that they’ve already implemented.

Both AutoHook and Clarivoy have differentiated themselves in the industry for their unrivaled ability to define the path that resulted in a vehicle sale. However, these two companies go about solving attribution problems from two different angles and perspectives. But, what they both always agree on is that the dealer’s perspective is the one that matters most. Dealers are not, nor should they ever be expected to be data analysts or mathematicians. It should never be a dealership’s responsibility to scrutinize the 20 different vendor reports they receive in a typical month and find trends that point to success or failure in their marketing and sales operations. It should never be the dealer’s job to assign fractionalized credit to the multiple touchpoints that led to a sale.

Too often, dealerships are debilitated by the excessive amount of one-sided vendor reports that flood their inbox every month. What good is all this data if it doesn’t include an instruction manual that pinpoints exactly what’s working and what’s not?

If you use outdated attribution models, you’re essentially making marketing decisions based on 10% of what is actually happening. That is a HUGE marketing blind spot that can lead to tens of thousands of dollars wasted on sources that don’t convert.

Wouldn’t it be refreshing if you could get a clear view of your sales and defection trends all in one place? Or quickly identify deficiencies in both your internal and external processes so that you can more efficiently assign responsibilities to your staff and get more ROI out of your third-party lead or traffic drivers?

What dealers have been lacking is a complete, 360° view of their sales operations, as well as the sales they lost to their biggest competitors. How can you improve the way you sell cars if you’re unaware of the leads in your CRM that have already purchased somewhere else? There is a reason for every lost sale, and that reason is exactly what you should use to take action and reclaim lost opportunities.

Attend this session and you will take away a lot more than the inspiration and motivation you need to take action. You will walk away with a game plan that you know has already proven to help individual dealers and dealer groups sell more cars and increase their market share. The topics of big data and attribution will transform from headaches, confusion, and irrelevant, obscure numbers into actionable steps to improve the way you operate today.

WHAT YOU’LL TAKE AWAY:

- Learn the fastest methods of uncovering actionable sales and defection trends hidden within your data.

- Define the sources responsible for your greatest opportunities and losses down to an individual salesperson, lead or traffic source, competing brand or dealer, and more.

- Eliminate “Marketing Blind Spots” and grow your market share using the automotive industry’s latest and most accurate attribution models.

Do yourself a favor. DO NOT leave Las Vegas deprived of this vital and enlightening knowledge. DO NOT return to your dealership in the dark. Join AutoHook, Clarivoy, and their panel of top dealers, to finally get a clear and complete view of your market and how to outshine the competition.

THE ACTION STARTS TUESDAY, OCTOBER 24TH AT 9:50 AM SHARP AT THE BELLAGIO IN MONET ROOMS 3 & 4!

EXECUTION: Uncovering Big Data's Missing Piece

by David Metter

The greatest marketing trends of all time began as insignificant ideas that eventually gained enough momentum to reach a critical tipping point – the point in which uncharted tools and technologies once overlooked by the masses are adopted by the mainstream. When ideas reach their tipping point, an infectious, unstoppable domino effect goes into play. The undiscovered becomes discovered, the unfamiliar becomes familiar, and the unknown becomes universal truth.

Just as the adoption of CRMs exploded in the early 2000’s and mobile marketing reached its tipping point circa 2014-2015, I believe big data has reached its culmination in 2017. I know this because I’ve seen the distinct black and white clarity today’s automotive data has finally been able to give to car dealers.

For the past several years, dealers have lacked significant visibility into their market regarding:

- Where and how they’re losing sales

- Who they’re losing sales to (whether the customer is purchasing the same make or another brand entirely)

- If sales are lost due to internal or external factors

- True successes, failures, and trends tied to each salesperson, lead or traffic source, inventory, day of the month, zip code, etc.

- Close and defection rates for all your leads and lead providers

- Validation that you are stocking the right inventory and marketing it in the most efficient manner

… the list goes on.

What we know now is that all of the items listed above are finally within reach. It’s also important to note that the problem has never been the data. It’s that dealers have only been able to view sales trends within their own CRM and DMS. How can you possibly improve your sales effectiveness if you’re only comparing it to yourself? The inability to see the sales and defection trends of top competing dealers and brands in your market has been a HUGE roadblock for dealers... until now that is.

Today’s big data landscape has evolved to become 100% executable. We can quickly gain insights from data using a scientific approach that exposes lost sales by source at an aggregate level. By knowing your lost sales opportunities, who you lost them to, and where you lost them, a strategic path towards increasing sales and reducing defection rates naturally comes into view – despite what your market conditions may look like.

We can even take it a step further and look at success and defection trends tied to an individual person within your sales staff. For example, if someone has a high close rate AND a high defection rate, you can break down where these lost opportunities are coming from. You can see that person is being assigned way too many leads and then you can make smarter decisions in terms of how you divide up your employees’ responsibilities.

When you can see where you’re losing sales across the board, you can then align your conversion goals, the operational training of your staff, and the way you drive traffic and leads into your dealership – so you can have the highest quality lineup of opportunities to close.

The advent of integrating automotive data to make more profitable operational decisions is similar in many ways to when CRM and DMS technologies were first implemented. Using these tools gave you a way to organize and streamline your process to help you sell more cars. The ability to execute smarter sales strategies using data analysis is no longer alchemy. It’s the current reality of this instant gratification world we live in, and it’s the weapon dealers need to be unstoppable.

Do You Have the Power to Know What You’re Losing?

by David Metter

The number of automotive reports dealership managers receive in a typical month drastically differs from the number of reports that empower them to take immediate action based on sales data only hours old. It’s as if dealers in today’s world have to excavate through mountains of analytical ruins in hopes of uncovering a single data-driven insight that may or may not impact their sales goals. Not to mention the hurricanes and natural disasters that have further obstructed an industry in its ninth month of national decline.

Auto marketing leader, Brian Pasch recently compiled a list of all the individual reports General Managers running a franchise dealership could typically get each month. “For auto dealers, the count is over 20 reports! All separate. All with different metrics. Lots of data, not many actionable insights,” says Pasch.

The overarching problem with most reports is that they only show one perspective of a much more dimensional, much more compelling story. A lot of vendors and their unique reporting methods tend to be biased in how they present results. In other words, they focus on what they’re helping your dealership win - whether it’s more clicks, more website traffic, or more leads.

But what about all the other pieces needed to complete the story? What about all the sales opportunities you didn’t win? What about the customers in your CRM your salespeople didn’t close? What about the active leads in your system you’re wasting time, money and effort chasing when in reality, they’ve already purchased from somewhere else? Wouldn’t having that knowledge save a lot of wasted energy and marketing dollars? Wouldn’t it be helpful to know as of yesterday how many sales you lost, which competitors you lost them to, and the reason why you lost them?

Furthermore, dealers need systematic visibility into the true outcomes of in-store customer interactions. We can’t solely rely on CRM data as it can be subject to human error. So the question is, does a report exist that accurately depicts the end result of every living, breathing, human-to-human exchange that physically takes place in your showroom? Did those personal interactions result in a vehicle sold or was the opportunity lost?

AdWeek published the following statement addressing this same issue:

“Over the past 20 years, analytics for digital ad measurement have focused on digital results (including web traffic, ecommerce conversion and data collection). But even though we live in an Amazon world, 92% of commerce still happens in physical brick-and-mortar locations, so measuring digital impact is nowhere near sufficient.”

For every digital action, there should be an equal and opposite reaction. What I mean by that is that all aspects of your digital marketing should strictly be evaluated based on their effectiveness or ineffectiveness of increasing vehicle sales that occur in the showroom. What we need now more than ever is a way to accurately discern if the money we’re spending on our digital marketing AND our in-store processes results in a closed sale or an opportunity down the drain. Those are the numbers dealers need to zero-in on to know the absolute best way to spend their marketing budget moving forward.

But wait! The good news is that a report currently exists that is capable of all of these things and more. This particular report defines attribution in a way this industry has never seen before. I will openly admit, there are few aspects of this tool that others out there have the potential to imitate. However, their numbers are based on 90-day old data, not near real-time sales match data. They also don’t provide a 360-degree view of your lost sales tied to a specific salesperson, lead or traffic source, model, or top competing dealer or brand in your market (all in one single report). How do you put a price on THAT?

Has the Promise of Big Data Finally Been Fulfilled?

by David Metter

Big data has been a big topic in automotive for a long time now. At this point, I think we’ve all realized there is a limitless digital warehouse of actionable data that exists. However, the struggle remains in deciphering how all the pieces fit together and translate into more sales. At the absolute core of the car business, when all the digital minutiae and politics are set aside, being able to prove sales is the only way to know if something is working. Owning the ability to prove sales in near real time is unquestionably big data’s most powerful accomplishment as far as the car business is concerned.

Perhaps the focus has simply been in the wrong place, or maybe it’s the fact that the focus has been in too many places. Dealers have been forced to adapt, master new technologies, implement new ways to operate and sell more cars all while being pushed in a million directions, attempting to distinguish between gratuitous opinions and actual science. It’s easy for dealers to lose sight of the end game when they’re stuck trying to figure out how the pieces fit together and how to create the story needed to turn data into action. This is why a lot of people view big data as nothing but a big problem.

I’m going to make this whole big data problem very small. The only data you need to start with, the only data that allows you to take immediate action is sales and service data, nothing else - and this is the reason:

We know that when customers physically walk into a showroom, closing rates jump to roughly 60-65%. Therefore, leads are important, but there’s no argument that showroom visits are more important than leads, and sales are more important than showroom visits. That’s the trajectory. If you’re using big data for anything other than proving sales or service revenue, you’re wasting your time. Sales have always been, and will always be the single most important dealership metric.

You also have to look at the history and trends of your past sales and the sales of your fiercest competitors. Too often, some of the most influential players in this industry forget that no two dealers are the same and no two markets are the same. Therefore, the data you need to own more of your market share may be much different from other stores, including each rooftop within a large or small dealer group.

In a lot of ways, big data is like a hammer. We can all go to Home Depot and buy the same hammer, but what we use it for, and what we ultimately build with that hammer is contingent upon its user. Choose to use your hammer better and smarter than the competition. Know that in order to do so, you also have to know how your rivals are using their hammer – in other words, the sales and defection trends of competing dealers in your market. It’s impossible to cut your losses if you don’t know they exist. You need to view both your opportunities and losses from a 360-degree, closed-loop vantage point. Big data exists not only to show you what you sold, but just as importantly, what you didn’t sell.

To put things into perspective, know that the power of big data transcends far beyond the car business. On a global scale, true improvement and change can only occur if a problem or a need for change is identified. Over the last decade, big data has proven its ability to influence the world’s greatest issues, including social change, government policy, and industry laws and regulations simply by its ability to demonstrate a need. When a need is identified, it then opens up the door for change.

In the TEDx Talk, “Stories are Just Data with a Soul, Chris Coates paints a very clear picture that data exposes needs by telling stories. “These stories can help people leaving prison to find work and stay out of prison and build new lives. They can save someone’s eyesight or their leg. Data can give children in the most deprived parts of the country chances in life they wouldn’t otherwise get.” What Coates is saying is that data alone has the capacity to change a life. If big data can change lives, it can absolutely change the effectiveness of your sales operations.

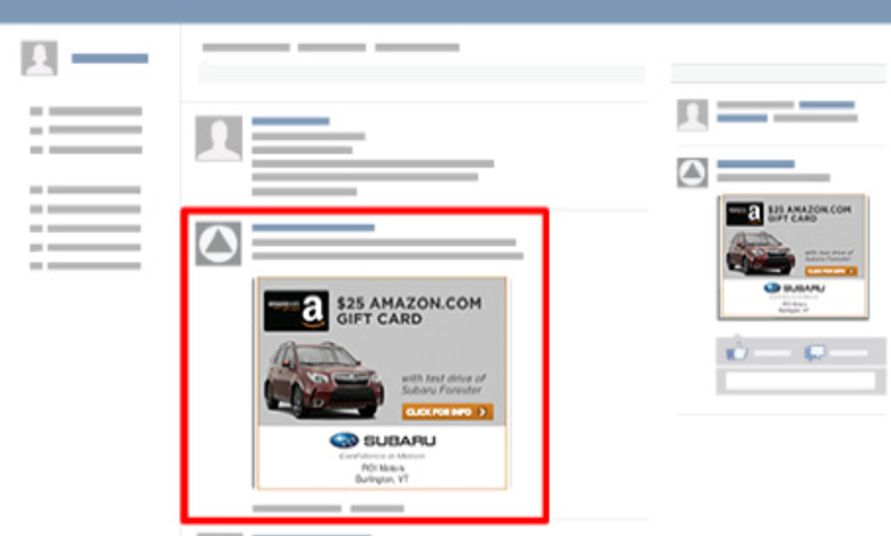

10 WAYS TO BOOST SOCIAL CONVERSION WITH AUTOHOOK INCENTIVES

A How to Guide for Dealers

Why Social? Marketing 101 says if you want to effectively reach your customers you have to be where they are, or “in the right place at the right time.” Social media represents the most widely utilized communication channel in existence. Salesforce reported 66% of all Internet usage occurs on social sites. Facebook takes the cake as the most widely used platform with 80% of Americans using it on a regular basis (talk about being where your customers are).

Why AutoHook Incentives? That’s an easy one. In order for a customer to redeem an AutoHook incentive, they have to physically walk into a dealership. We all know the chances of selling a vehicle drastically increase when you’re able to get shoppers off the Internet and into your store. But what AutoHook does that’s even more important than driving more showroom visits (yes there are more important things), is we use the most up-to-date sales match reporting to prove exactly which incentive offers resulted in a sale.

Below are 10 ways to boost the revenue driving opportunities already available to you as an AutoHook customer. Simply reach out to your AutoHook Client Service Specialist (CSS) to implement any of the examples listed below. They will help you set up campaigns and make sure these efforts convert into sales or service appointments.

1. PLUG INCENTIVES INTO YOUR EXISTING SOCIAL CAMPAIGNS

Plugging in an incentive into any social campaign is very simple to do. All AutoHook needs to know is the URL of the landing page you want to drive traffic to - whether it’s a specific vehicle, model, service offer, or special. We then provide you with a trackable link you can drop into any Facebook or social campaign. We attach a unique identifier to every offer so we can prove sales attribution for your store. Furthermore, we source out every link separately so that you can differentiate which specific AutoHook campaign converted into a showroom visit or sale in your CRM.

- Customize Time Frame & Offer Amount: All we need from you is the landing page you’d like to promote, the value of the incentive you’d like to offer and the time frame in which you’d like the campaign to run.

- Ex: Boost your new vehicle specials with a $50 offer.

2. USE YOUR CRM DATA TO CREATE CUSTOM AUDIENCES

We know no two dealers and no two markets are the same. Therefore, we don’t believe in one-size-fits-all solutions. Despite what vendors try to tell you, no one knows your pain points better than you. The most valuable data you have at your fingertips is your own customer data. Use this to pull targeted lists that address your unique needs and then work with a Client Service Specialist (CSS) to implement the campaign on social.

Here are a few examples to get the wheels turning:

- Pull a list of customers who are in equity and provide an incentive for them to get into a new vehicle for the same monthly cost.

- Consolidate a list of all active leads across all your 3rd party sources and retarget those individuals all in one place.

- Use equity-mining software such as AutoAlert to identify all customers in your market who have upcoming contracts ending on a lease or purchase.

- Target customers who visited your service drive but did not purchase from you.

3. ELIMINATE WASTED TIME & MONEY

Wouldn’t it help to know which leads in your CRM have already purchased so you don’t waste time and money trying to sell them? A high percentage of car buyers are only in market for a relatively short period of time. Through near real time sales data from Urban Science, AutoHook can help you identify which customers are no longer in market for a vehicle. No one (not even the OEMs) has access to this data within DAYS after sales transactions occur (rather weeks or months). Work with your CSS to create a suppression list of all the customers currently in your CRM that have already purchased a vehicle elsewhere.

4. INCREASE CUSTOMER RETENTION

This is a HUGE and often undervalued aspect of the car business. Retention is half the battle. We know 30% of people will defect to a different brand after their lease is up. Use an incentive to ensure they come back to your store to test drive the newest model or any other vehicle they might be interested in. Mine your CRM data to find consumers who are “in equity” or who have a lease coming to term in the next 3-6 months.

5. TARGET UNDERPERFORMING MODELS

Real Dealer Case Study: Germain Ford of Beavercreek

- Using the data found within the MarketMaster tool and Urban Science’s shared sales database, AutoHook identified specific areas of opportunity for Germain Ford of Beavercreek to grow their market share by targeting the top three models they were losing to competitors (including the Ford Focus, Fusion, and Edge). We then implemented a $50 test-drive incentive on all Focus, Fusion and Edge VDPs and SRPs, while running social campaigns to drive traffic to those pages. The result was a 47% reduction in overall lost sales (pump-in). Click here to see the complete case study.

Can’t move a VIN off your lot? Try increasing the dollar amount of the test-drive incentive.

6. TARGET UNDERPERFORMING AREAS

Utilizing Market Master, AutoHook can help you identify the zip codes in which you’re losing the most sales opportunities. We can also show you the areas with the highest levels of pump-in sales and increase the incentive offer to come in for a test-drive in those underperforming areas. This will help you take back market share from the top brand competitors in your market.

Never heard of Market Master? A lot of dealers don’t know this powerful revenue driver exists. Market Master is an Urban Science tool that uses near real-time sales data to identify the biggest areas of opportunity within your market. It’s typically located within your dealer portal through your OEM (currently available for Ford, FCA, Honda, Hyundai, Toyota, and Nissan).

7. CONQUEST TOP COMPETING BRANDS

Go after the models you know you’re losing to competitive brands in your market. Tailor the creative and messaging in your social ads to express why your brand is the better choice. For example, “Before you go back into a new Ford F150 here’s a $50 Visa Gift Card to come in and test drive the Dodge Ram at Hometown Chrysler.”

8. PLUG INTO VIDEO PRE-ROLL

Custom links can be embedded directly into your video ads on Facebook. Need to move more of a certain model, try offering $25-50 just for coming in to test-drive the featured vehicle. Chances are, if they’re watching the video, they’re already interested.

9. SECURE MORE FIXED OPS APPOINTMENTS

Running service specials? Why not promote them on social to get more exposure? Use incentives in your service and parts campaigns on social sites. Here are a few examples:

- Schedule a service appointment and get a $25 Visa gift card.

- Buy 4 tires get a $50 Visa Gift Card.

- Get a $10 Amazon Gift Card just for getting your oil changed with us.

10. BOOST HOLIDAY SPECIALS

Memorial Day is coming up! Lift the performance of your limited time holiday offers with a $25 gift incentive (or an amount of your choice). Dealers spend countless amounts of money to get customers in the door. Why not spend another $25 to ensure the sale? This same idea can be deployed throughout the year to increase sales around the holidays and give wings to your current specials and holiday sales events.

To conclude, the opportunities in which you can leverage AutoHook to boost the performance of your social campaigns are limitless. Plus you have the attribution reporting that goes along with it, so you know we’re delivering results in the form of sales and service revenue.

In January of 2017, AutoHook opened up our API so that other best in class technology vendors could tie in our incentive offers to their own existing solutions. SOCIALDEALER is the latest partner to join in our open API initiative. Current and future clients of SOCIALDEALER will see even higher form fill conversion rates on social due to their integration with AutoHook’s API. To learn more about the new capabilities of this partnership, click here.

What You Need to Know About DMPs

by David Metter

DMPs are a topic gaining escalating attention as we head into 2017. A dark cloud of big, irrelevant data still lingers above the automotive industry, just waiting to be analyzed. What are DMPs? For those of you that don’t know, the acronym stands for Data Management Platforms. Think of a DMP as a digital warehouse of data, designed to consolidate and organize consumer data from multiple sources all in one place so that it can be put to good use.

eMarketer addressed the need for advertisers to utilize DMPs back in 2013 – a near decade ago in digital time. “If data is digital marketing’s currency, then the DMP is its bank.” So, when it comes down to whether or not to use DMPs either at the dealer or manufacturer level, really dig deep and ask yourself… do you like money?

If the answer is yes, DMPs exist to give you insights that will help you make more and save more (money that is). DMPs consolidate past and real-time consumer purchase and behavioral data across ad exchanges, networks and devices. This allows for granular audience segmentation and targeting that goes far beyond standard demographics.

DMPs aren’t just a place to aggregate and store information. They help us find the most important data points that will actually help our business. And I don’t mean help down the line or months from now, but this very second. DMPs empower us to take action and deploy personalized campaigns with quantifiable conviction. These platforms are the secret to affirming what every advertiser claims they will do, which of course is to “place the right ad, in front of the right consumer, at the right time.” Sound familiar? Without DMPs, these empty promises would remain just that - empty and unproven.

DMPs are the ultimate source of budgetary efficiency for both digital and traditional spending. By illuminating a clean, 360-degree view of a consumer’s online and offline actions, DMPs pinpoint how far along car shoppers are in the buying process. They identify who in the market has already purchased a vehicle and if they bought it from a competitive dealership or brand. On the contrary, they show which consumers are just beginning their research journey, still months away from a buying decision.

Put simply, DMPs hold your campaigns accountable for their performance and help to guide your ongoing efforts to be more relevant, impactful, and efficient with where you spend your money and who you spend your money on. Specifically for the automotive sector, DMPs may be the solution to a lot of our sales attribution problems. Everyone wants to stake claim for a vehicle sold. A DMP may be just what we need to properly assign credit where credit’s due.

When asked about DMPs, Erik Lukas, Retail Operations Manager of Subaru of America said, “If there’s ever any hope of attributing all these touch points along the shopping journey, you’ve got to have some place where all the data rolls up and you can analyze it as one set.” Aside from attribution, another much-needed use for DMP-derived insights would be for one-to-one marketing and campaign personalization. Both are becoming increasingly necessary in order for a message to stand out and resonate with car shoppers.

According to MarTech Today, “A DMP offers a central location for marketers to access and manage data like mobile identifiers and cookie IDs to create targeting segments for their digital advertising campaigns.” This is a tremendous asset for automakers when it comes to eliminating waste. For example, if you are a luxury vehicle manufacturer, DMPs can help you only target individuals or households that you know have a net income of at least $200,000 per year.

In summary, the biggest uses for DMPs in the auto industry include:

- More accurate sales attribution

- More opportunities for personalization and one-to-one marketing

- Ideal audience targeting and segmentation

Data management platforms are about unification – unifying consumer data from one source to the next as their shopping journey becomes more and more complex. Big data fails to hold value unless it can be applied to better influence your most lucrative audience segment. Other industries have been using DMPs for years. Automotive has such a complex business model given our three-tier system and the fact that most transactions happen offline. Therefore, we need DMPs more than anyone.

The opportunities DMPs provide are limitless. But don’t get too wrapped up in all the ways you could use them to your advantage. Remember your one objective at the end of the day is to increase dealership revenue by selling more units and obtaining more ROs. Above all, SALES is the metric that matters and DMPs should be used primarily to generate more sales. Everything else is just noise.