by David Metter

People buy everything online these days. Or do they? In reality, there are some items people simply prefer to touch, see, feel, taste, smell, or drive before they consider signing on the dotted line or forking over their credit card. Several automotive leaders have recently come out in the media claiming a vehicle is still in so many ways, one of those items.

Online car buying models have been a ubiquitous topic of conversation over the past year – one that has made many in our industry uneasy about what to expect in the future as companies like Carvana, Drive Motors, and Vroom claim their place in the market.

We’re now in the fourth quarter of 2016, the time when we line up our budgets for the year ahead. Which technologies will thrive and which will die? Will the option to offer a complete online buying method for our new and used vehicles become necessary? According to DealerSocket, “There’s a false sense of urgency to take car buying online.” If you were to ask me, I’d say the vast majority of consumers are still not ready for it.

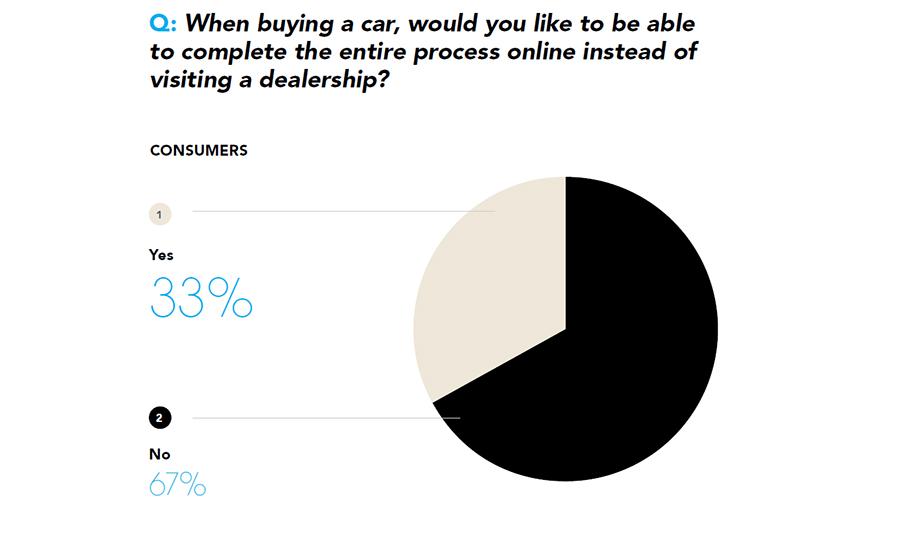

In a recent article from Automotive News, they highlight the results of DealerSocket's 2016 Dealership Action Report. “While there is a segment of car shoppers who want to buy vehicles online in an Amazon-like experience, a new report indicates dealers may be overestimating how strong consumer demand for this capability really is.”

Actual responses are shown below:

Without a doubt, there are items consumers prefer to purchase online, things like books, electronics, or your go-to cologne. It’s also true that there is a current market of buyers that want the ability to purchase a vehicle online. However, relatively speaking, that number is still small - small enough that we can all take a big deep breath and let go of worries about completely changing our buying models and the way we market our inventory.

When it comes to big-ticket items, people overwhelmingly still choose to visit actual brick-and-mortar stores. A new eMarketer study revealed it’s not just the large items. When it comes to packaged goods or groceries, the market is not budging despite having the option for online grocery shopping and at home delivery. eMarketer emphasized several valid reasons why 90% of internet users still prefer to do their grocery shopping in-store. These same reasons for opting out of online buying can be directly applied to the car business.

If your dealership is contemplating integrating an online sales platform in 2017, make sure you consider the following five facts before taking on this monster:

1. When people are ready to buy, the ability to purchase immediately in-store is still very desirable as there is comfort in seeing, touching and testing products (or vehicles) in person.

2. Completing a lengthy online purchase request may be too time-consuming for customers to follow through with the entire process.

This past August, Alex Jefferson, eCommerce director of Proctor Dealerships said, “Where online buying is going I don’t necessarily know, but I do know that it did personally have an adverse effect on us when we integrated with the tool. I will tell you after a year of testing it, our lead volume went down by about 30-40%.”

3. Less tech-savvy customers or older generations who have the dealership experience ingrained in their mindset may struggle with the concept or dismiss it altogether.

4. Consumer income levels largely dictate their level of interest in whether or not they would prefer to buy a vehicle online.

“Half of surveyed consumers earning $100,000 to $149,000 annually would like to bypass the dealership and buy vehicles online, DealerSocket said. In contrast, 29 percent of people making $25,000 to $49,000 said they'd like to buy vehicles online.”

5. Online buying models may be better suited for luxury or high-end electric vehicles only – one of the reasons Tesla has been successful selling almost exclusively online.

Forbes explained why a direct sales model works for Tesla. “Since electric vehicles do not need as much regular service and the company does not offer financing schemes, a dealership model would put pressure on its margins.”

Marylou Hastert, DealerSocket's Director of Product Marketing advises dealerships, “Stores should prepare for the digitization of car buying, but not at the expense of in-store processes.” Simply put, an online buying model may not be right for your dealership. It could even be harmful to your conversion rates, which dealerships have reported over the last year.

My expert opinion? Get your fundamentals down first before heading full-speed down the click-to-buy road. Online buying has been effective with some of the larger dealer groups, but they have already conquered the essentials. After you have mastered the art of securing a high-converting website and high converting forms across devices, and once your inventory is immaculately merchandised with video walkarounds, photos, and custom comments, THEN and only then should you experiment with an integrated online buying model.

![Part II: The Naked Truth Exposed [Paid Search, Retargeting & Budget Allocation]](https://images.squarespace-cdn.com/content/v1/549d823ee4b055cfe6cde6e7/1473176847039-RT2U82DF4UC20YFKQZI0/Copy+of+Part+2-+NT.png)