by David Metter

Could it be possible that the secret to selling cars in today’s multi-touch, exponentially data-driven society is exactly the same as it was prior to World War II? I know what you’re thinking. This is either a huge stretch or some sort of joke. However, recently uncovered sales training documents dating back to 1939 tell a very unexpected story that directly parallels the fundamental methods dealers need to sell more cars today.

This handbook published by General Motors in 1939 on how to manage new car sales was recently passed along to me, and as I read through it, I was completely blown away. I think anyone who has been in the car business for a while will appreciate this…

It states, “The sales manager must have a keen desire to check such things as the number of people buying competitive cars with whom his own organization has been in contact, the reasons why such deals were lost, the reasons why any particular competitor is making headway locally, and similar vital facts to which the average dealer pays little or no attention.”

In one sentence from a 219-page book from 78 years ago, we can derive three secrets to selling cars that remain true today. Not only are these tactics relevant to the way dealers currently operate, but they are also the difference between a dealership that’s running successfully and efficiently and a dealership on the verge of failure.

Below are the three operational insights that have endured in this industry throughout generations, wars, and the age of the Internet that changed everything as we know it… or did it? These takeaways will continue to be the foundation of how to sell cars in 2017 and into the future.

Dealers need complete visibility into:

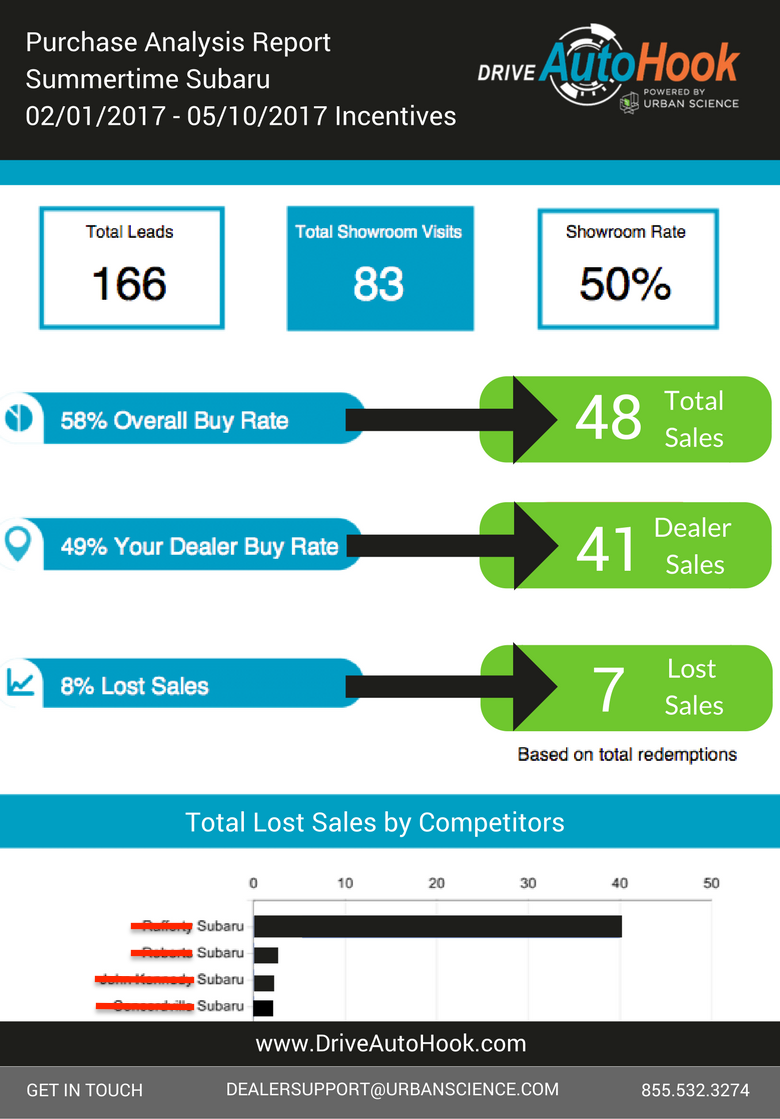

- The number of people buying competitive cars that your own dealership has been in contact with.

- The reasons or sources responsible for these lost opportunities.

- The reasons why a local competitor may own more market share than you do.

This is so interesting to me because these are things GM recognized back in 1939 and STILL today we struggle with being able to put our finger on the number of opportunities we lose each month and the sources (or people) responsible for these losses. A sales manager that concerns themselves with not just their own dealership’s performance but also the performance of their top competitors and defection rates to other dealers or brands is a sales manager with A LOT of common sense!

If a customer is walking into your store, interacting with your staff, and leaving to purchase a vehicle from somewhere else, there’s always a story to uncover as to why. The problem in the digital world we live in is that dealers lack visibility into all the different sources, touchpoints, and online or in-person interactions that may have played a roll in a lost sale.

A lot of these operational inefficiencies are due to the fact that we can only see data from a one-dimensional perspective. What I mean by that is dealers don’t have a comprehensive, multifaceted view of all their different deposits of data – specifically, your CRM & DMS for the following reasons:

- You can only see the leads that come into your dealership.

- You only see the opportunities you’re working.

- Ultimately when leads get to your DMS you can see sales, but what you don’t see is the customers that defected and who they bought from.

- You don’t see the dealership next door and what is in their CRM and you CERTAINLY can’t see what’s in their DMS, and that’s a HUGE blind spot.

Because of the fact that no two dealers are the same and no two markets are the same, there will always be a different sickness, prescription, and remedy for each and every dealership. If you have a clear view into the ailments in your processes associated with each lost sale, you can then derive the information you need to make beneficial changes to reduce your rate of defection both to other brands or other same make dealers in your market.

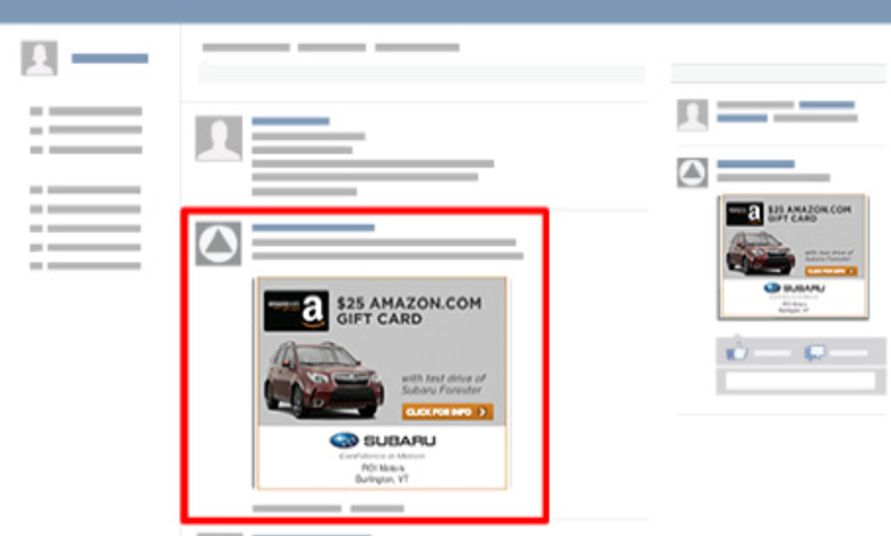

Identifying the number of lost sales opportunities in your CRM is just the first step. The second is integrating technology that exposes where the problems are in your sales processes. Maybe it’s a third party lead provider with a high close rate and a high defection rate - meaning you need to go after leads from that particular source more aggressively or put more marketing dollars towards those leads to reduce the defection rate.

Or maybe you have a salesperson with a high close rate and a low defection rate that should be handling more opportunities. Maybe you have high defection rates tied to a particular model in your inventory, so you then know it would be a good idea to increase incentive offers around that vehicle.

Most vendors and digital advertisers only provide a one-sided perspective of your data, which is why big data has been so limiting at the dealership level. Dealers know they’re losing sales, but they don’t know where, to who, or why. If you can see the full picture, you can then start to put together the pieces of the puzzle around whether or not you had the right inventory, or did you have the right selling strategy against your competitors, and who are you truly competing with? The obscure, blurry picture of your market’s sales trends starts coming into focus. So in summary, what we need to do is start incorporating that 1939 mentality back into the way we operate.