In a down market, Morrie’s Brooklyn Park Subaru experienced a considerable decline in lead volume from April to June of 2017. In addition to a large drop off in leads, their lost sales and defection rates were significantly higher than the national sales trends. They needed a solution to identify the source of all lost sales and a strategy to reduce the rate of defection to other dealers, while growing their market share in surrounding zip codes.

Winning Means Knowing What You’re Losing

3 Steps to Reduce Lost Sales

by David Metter

1. Use Data That Tells a Complete Story

The only way to know exactly where you stand in your market is to have a clear view of what you’re losing. The problem the automotive industry has faced for years now, is that both CRM and DMS data is one-sided, one-dimensional, and only shows your effectiveness against your own sales. But what about the sales of competing dealers or brands in your market? Wouldn’t it be easier to grow your market share if you knew what percentage of it you actually owned compared to your top competitors?

The other problem exists within the reporting provided by some third party vendors, as these reports only show you one side of the story – their side. In other words, what you’re winning. If you think about it, what is the most vital piece of information to have in terms of improving your dealership’s sales operations? Is it how many clicks your VDPs got or is it how many actual vehicles you sold…or didn’t sell? You be the judge.

2. Accurately Quantify Your Lost Sales Opportunities

What if you could know which dealerships you’re losing sales to? How many units per day or per month are you losing to competitors? How many of your customers purchased from competing dealers or brands in your market?

It is critical for dealers to not only look at their own data and sales and defection trends, but also the sales trends of their biggest competitors. Know where you stand. If you have a clear view of what and how much you’re losing, then you have a clear view of what you need to win back.

3. Identify the Source of Lost Sales & Adjust Accordingly

There are several factors that play into each and every lost sale. What dealers need is the ability to recognize if sales are lost due to internal or external factors. For example, is there an internal problem with your sales staff or with a specific salesperson? Are your lost opportunities tied to a certain model? Or, is it an external problem such as one of your lead providers consistently delivering leads that are no longer in consideration? Look into your website traffic and the traffic providers you work with. Are these sources driving low-funnel buyers to your showroom, and can they prove it?

If you don’t know the answer to that question, it’s because you’re not seeing the full picture. You can’t fix a problem if you don’t know the problem exists. Similarly, you can’t make smarter decisions with your marketing budget if you don’t know which sources are driving bad traffic or causing high defection rates.

Now that we’ve identified all these potential problem areas, allow me to leave you with the light at the end of the tunnel. The good news is that the tools and data needed to complete the story of your market’s sales trends already exist. I know this because I’ve been on both sides of the equation. I’ve worked as the CMO of a large dealer group, and I’m currently on the vendor side of the car business. Therefore, I can say with confidence that attempting to grow your market share without a complete view of your market in today’s complex landscape is asinine. I can also say based on factual, proven stats that Urban Science has the fastest, most accurate sales match data in existence. So at the end of the day, you can go with your gut, or you can go with prescriptive science-based conviction. (I suggest the latter).

To learn more about identifying and eliminating lost sales, visit DriveAutoHook.com/TCA.

CASE STUDY: Boucher Hyundai TRIPLES Sales Efficiency With AutoHook Incentives

In order to overcome the challenges and heightened competition of a flat market, Boucher Hyundai needed a way to protect their territory by increasing their market share, improving their sales efficiency, and reducing the incidence of lost sales to other dealers in their PMA.

SEE HOW WE DID IT! CLICK HERE TO DOWNLOAD.

INTRODUCING: THE ALL-NEW SALES MATCH REPORT

AutoHook Releases Purchase Analysis Reports for Current Clients

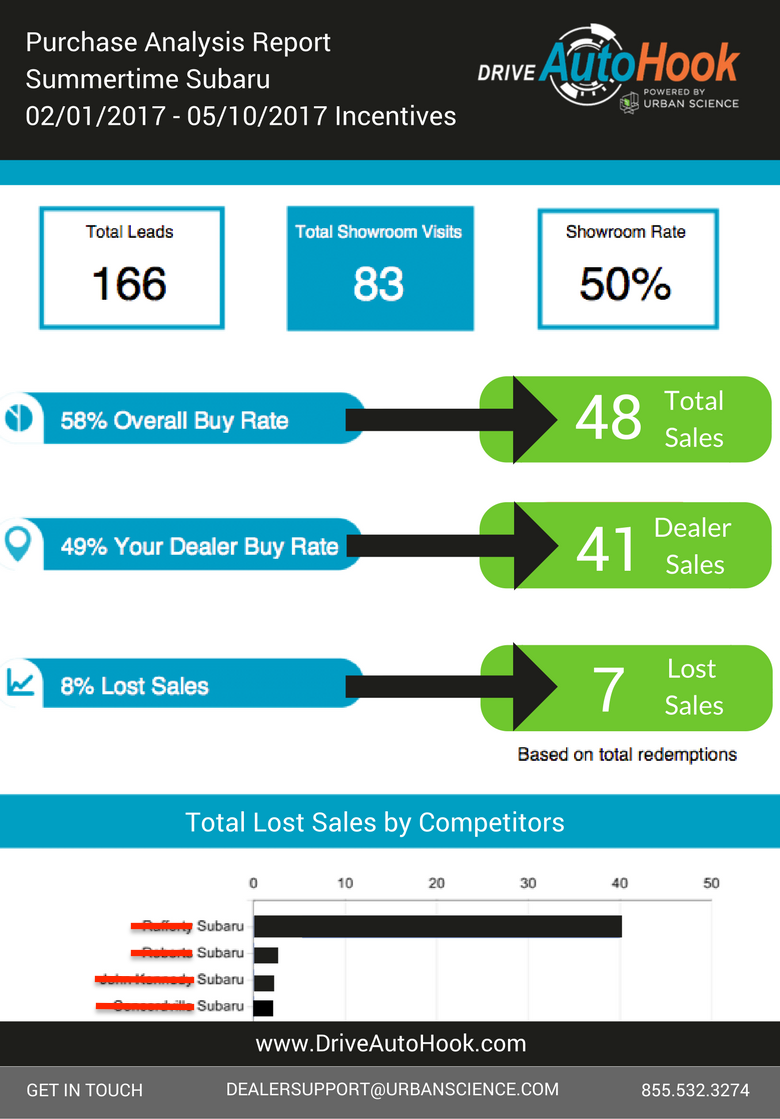

As of May 2017, AutoHook released an all-new dealer sales match report, further solidifying their place in the industry as the true definition of automotive attribution. Current clients will now have a 360-degree view of their dealership’s sales, conquest, and defection trends based on data only hours old, as opposed to 90-day old registration data used in previous reporting.

REPORT ENHANCEMENTS

The Closest to Real-Time Data in Existence

This is no joke. Urban Science has the only Shared Sales Database that allows our clients to see sales effectiveness across multiple car brands in near-real time. Thus, we can report back on the numbers faster than the OEMs themselves, giving dealers:

- First-time visibility into sales and defection to other dealerships and brands.

- The knowledge required to take control of your dealership’s marketing and operations.

- Names of defectors to like-brand dealers as well as competitive brands.

AutoHook’s current dealer and OEM clients will have a significantly more actionable snapshot of their market conditions. Urban Science’s new vehicle sales matching data is now being directly pulled into AutoHook’s private offer and redemption platform for the generation of weekly reports.

Your Total Lost Sales by Competitor

This is a big one! Prior to this release, dealers could only see how many total sales they lost to competitors. Now, you have complete visibility into competing dealerships in your market (by name) that you lost sales to. This is what is known as “actionable data.” If you are a Hyundai Dealer and you’re losing the most sales to Hometown Hyundai down the street, you can then work with AutoHook to deploy a targeted conquest incentive campaign to reduce pump-in sales. OEM clients receive even more in-depth reporting on the number of new to brand buyers AutoHook delivered to their stores.

Customize Your Report View

Your AutoHook Client Service Specialist (CSS) can also generate a custom Purchase Analysis Report to show sales match data from any date range of your choice.

Weekly Updates

Each dealer’s Purchase Analysis Report will include their previous three full months of sales data in addition to their metrics through the current month to date. Reports are updated and reran each week, guaranteeing the most current metrics as well as sales lost to other brands or dealers in the market. Your CSS will review these reports with you on a one-on-one basis and offer recommendations as to how AutoHook can help you grow your market share and reclaim lost sales from competing stores.

REAL PURCHASE ANALYSIS REPORT EXAMPLE

An example of the new Purchase Analysis Report from an actual dealer is shown below. (The dealership’s name and competing dealer names have been changed to protect their privacy).

Starting Summer 2017, AutoHook Purchase Analysis Reports will be automatically sent out weekly to all dealer clients. In the mean time, please reach out to your CSS or DealerSupport@UrbanScience to access your sales report based on your AutoHook test drive incentive redemptions. Or please contact us with any questions. Enjoy!

10 WAYS TO BOOST SOCIAL CONVERSION WITH AUTOHOOK INCENTIVES

A How to Guide for Dealers

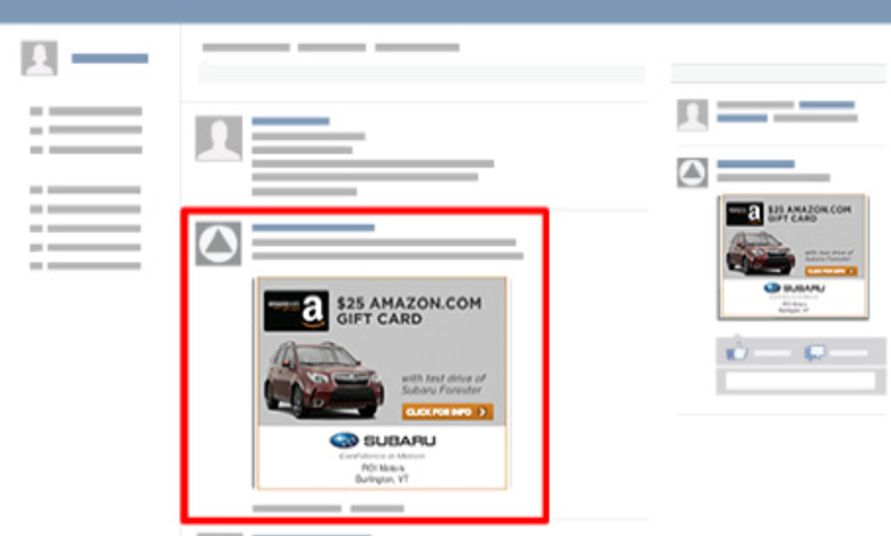

Why Social? Marketing 101 says if you want to effectively reach your customers you have to be where they are, or “in the right place at the right time.” Social media represents the most widely utilized communication channel in existence. Salesforce reported 66% of all Internet usage occurs on social sites. Facebook takes the cake as the most widely used platform with 80% of Americans using it on a regular basis (talk about being where your customers are).

Why AutoHook Incentives? That’s an easy one. In order for a customer to redeem an AutoHook incentive, they have to physically walk into a dealership. We all know the chances of selling a vehicle drastically increase when you’re able to get shoppers off the Internet and into your store. But what AutoHook does that’s even more important than driving more showroom visits (yes there are more important things), is we use the most up-to-date sales match reporting to prove exactly which incentive offers resulted in a sale.

Below are 10 ways to boost the revenue driving opportunities already available to you as an AutoHook customer. Simply reach out to your AutoHook Client Service Specialist (CSS) to implement any of the examples listed below. They will help you set up campaigns and make sure these efforts convert into sales or service appointments.

1. PLUG INCENTIVES INTO YOUR EXISTING SOCIAL CAMPAIGNS

Plugging in an incentive into any social campaign is very simple to do. All AutoHook needs to know is the URL of the landing page you want to drive traffic to - whether it’s a specific vehicle, model, service offer, or special. We then provide you with a trackable link you can drop into any Facebook or social campaign. We attach a unique identifier to every offer so we can prove sales attribution for your store. Furthermore, we source out every link separately so that you can differentiate which specific AutoHook campaign converted into a showroom visit or sale in your CRM.

- Customize Time Frame & Offer Amount: All we need from you is the landing page you’d like to promote, the value of the incentive you’d like to offer and the time frame in which you’d like the campaign to run.

- Ex: Boost your new vehicle specials with a $50 offer.

2. USE YOUR CRM DATA TO CREATE CUSTOM AUDIENCES

We know no two dealers and no two markets are the same. Therefore, we don’t believe in one-size-fits-all solutions. Despite what vendors try to tell you, no one knows your pain points better than you. The most valuable data you have at your fingertips is your own customer data. Use this to pull targeted lists that address your unique needs and then work with a Client Service Specialist (CSS) to implement the campaign on social.

Here are a few examples to get the wheels turning:

- Pull a list of customers who are in equity and provide an incentive for them to get into a new vehicle for the same monthly cost.

- Consolidate a list of all active leads across all your 3rd party sources and retarget those individuals all in one place.

- Use equity-mining software such as AutoAlert to identify all customers in your market who have upcoming contracts ending on a lease or purchase.

- Target customers who visited your service drive but did not purchase from you.

3. ELIMINATE WASTED TIME & MONEY

Wouldn’t it help to know which leads in your CRM have already purchased so you don’t waste time and money trying to sell them? A high percentage of car buyers are only in market for a relatively short period of time. Through near real time sales data from Urban Science, AutoHook can help you identify which customers are no longer in market for a vehicle. No one (not even the OEMs) has access to this data within DAYS after sales transactions occur (rather weeks or months). Work with your CSS to create a suppression list of all the customers currently in your CRM that have already purchased a vehicle elsewhere.

4. INCREASE CUSTOMER RETENTION

This is a HUGE and often undervalued aspect of the car business. Retention is half the battle. We know 30% of people will defect to a different brand after their lease is up. Use an incentive to ensure they come back to your store to test drive the newest model or any other vehicle they might be interested in. Mine your CRM data to find consumers who are “in equity” or who have a lease coming to term in the next 3-6 months.

5. TARGET UNDERPERFORMING MODELS

Real Dealer Case Study: Germain Ford of Beavercreek

- Using the data found within the MarketMaster tool and Urban Science’s shared sales database, AutoHook identified specific areas of opportunity for Germain Ford of Beavercreek to grow their market share by targeting the top three models they were losing to competitors (including the Ford Focus, Fusion, and Edge). We then implemented a $50 test-drive incentive on all Focus, Fusion and Edge VDPs and SRPs, while running social campaigns to drive traffic to those pages. The result was a 47% reduction in overall lost sales (pump-in). Click here to see the complete case study.

Can’t move a VIN off your lot? Try increasing the dollar amount of the test-drive incentive.

6. TARGET UNDERPERFORMING AREAS

Utilizing Market Master, AutoHook can help you identify the zip codes in which you’re losing the most sales opportunities. We can also show you the areas with the highest levels of pump-in sales and increase the incentive offer to come in for a test-drive in those underperforming areas. This will help you take back market share from the top brand competitors in your market.

Never heard of Market Master? A lot of dealers don’t know this powerful revenue driver exists. Market Master is an Urban Science tool that uses near real-time sales data to identify the biggest areas of opportunity within your market. It’s typically located within your dealer portal through your OEM (currently available for Ford, FCA, Honda, Hyundai, Toyota, and Nissan).

7. CONQUEST TOP COMPETING BRANDS

Go after the models you know you’re losing to competitive brands in your market. Tailor the creative and messaging in your social ads to express why your brand is the better choice. For example, “Before you go back into a new Ford F150 here’s a $50 Visa Gift Card to come in and test drive the Dodge Ram at Hometown Chrysler.”

8. PLUG INTO VIDEO PRE-ROLL

Custom links can be embedded directly into your video ads on Facebook. Need to move more of a certain model, try offering $25-50 just for coming in to test-drive the featured vehicle. Chances are, if they’re watching the video, they’re already interested.

9. SECURE MORE FIXED OPS APPOINTMENTS

Running service specials? Why not promote them on social to get more exposure? Use incentives in your service and parts campaigns on social sites. Here are a few examples:

- Schedule a service appointment and get a $25 Visa gift card.

- Buy 4 tires get a $50 Visa Gift Card.

- Get a $10 Amazon Gift Card just for getting your oil changed with us.

10. BOOST HOLIDAY SPECIALS

Memorial Day is coming up! Lift the performance of your limited time holiday offers with a $25 gift incentive (or an amount of your choice). Dealers spend countless amounts of money to get customers in the door. Why not spend another $25 to ensure the sale? This same idea can be deployed throughout the year to increase sales around the holidays and give wings to your current specials and holiday sales events.

To conclude, the opportunities in which you can leverage AutoHook to boost the performance of your social campaigns are limitless. Plus you have the attribution reporting that goes along with it, so you know we’re delivering results in the form of sales and service revenue.

In January of 2017, AutoHook opened up our API so that other best in class technology vendors could tie in our incentive offers to their own existing solutions. SOCIALDEALER is the latest partner to join in our open API initiative. Current and future clients of SOCIALDEALER will see even higher form fill conversion rates on social due to their integration with AutoHook’s API. To learn more about the new capabilities of this partnership, click here.

IS VENDOR INTEGRATION THE NEW INNOVATION?

A Tale That Proves 2 Technology Leaders are Better Than 1

By David Metter

Too many companies these days suffer as a result of being close-minded. They think innovation means constantly developing new solutions to better service dealers and OEMs. I’d like to challenge that mindset. What happened to sticking with what you’re best at? I’m not saying don’t dream big, but I am recommending you dream a little smarter. Too often vendors attempt to do things they’re never going to be good at. For example, I know AutoHook will never be great at social advertising. We could do it, and we could do a decent job, but what’s the point of doing anything if you don’t do it right?

Great solutions are a result of knowing what you’re best at and holding on tight to that. In my opinion, strategic partnerships might just be the new and improved form of innovation within the automotive space – and here’s why. AutoHook’s core competency is securing our private offer and incentive rail system within dealerships and directly proving the source that led to a sale or a new to brand buyer. We’re great at attribution reporting because of the data we have access to through Urban Science. We’re never going to be great at Facebook ads, but we know SOCIALDEALER is.

To provide some color, AutoHook opened up our API in January of 2017 so that reputable partners could access our redemption platform and proven attribution engine at no cost to them or their dealer clients. SOCIALDEALER is the latest company to join in our open API initiative to advance actionable data and simply deliver a higher ROI through these types of technology integrations.

SOCIALDEALER’s core competency is in converting customers through social media advertising. Now that they have tied into the redemption rail system AutoHook has already put into place, they can prove exactly which social campaigns resulted in an incremental sale or service appointment. Having the ability to tie in what we’re best at with what another vendor is best at and execute on that to sell and service more cars (and prove it)…now that, that is innovation.

By integrating with our private offer and attribution API, SOCIALDEALER can do more than just show conversions from their solutions to more showroom traffic. They can validate to their dealer clients if a vehicle was purchased as a direct result of their own existing ad platform. This open and unified approach presents countless opportunities for innovation that benefits all parties involved. Most importantly, it benefits the dealers and OEMs that no longer have to pay the integration fees vendors typically charge to work with other vendors.

Here’s a breakdown of how this whole open API thing works. SOCIALDEALER can now use AutoHook’s redemption rail system to serve inventory-specific test drive offers to highly targeted audiences on Facebook. For example, if a customer views a vehicle details page on a dealer’s website and later goes on Facebook to post a picture of their cat, SOCIALDEALER will then retarget that shopper and strategically plug in an AutoHook incentive to visit XYZ dealer to test-drive the vehicle they previously viewed or showed interest in. Through a vast network of data partners (yes more vendor integration) SOCIALDEALER will plug a test drive incentive offer directly into their Facebook ads AND with prepopulated form fields. All the customer has to do to redeem their incentive is hit submit and show up at the dealership. No one else in the space can do that.

We know conversion rates decrease when a customer is asked to fill out an online form with several fields of their personal information. Adding incentives to forms absolutely lifts conversion, but having the form already filled out with the customer's name and contact information, that’s just a no-brainer. That’s why this partnership defines innovation (along with all the other vendors in our API Partner Program).

Think about Salesforce and what happened after they decided to open up their interface and allow third party providers to integrate, for free. Their revenue grew exponentially and their adoption rates blew up. Now you can have video conference calls, send emails, post to social sites, and sign contracts all within Salesforce. Their AppExchange literally has 1,000 different apps available to their customers. That’s beyond valuable, and that’s exactly what being a little more open-minded can do for automotive. I mean heck, look what it did for Apple!

To learn more about AutoHook’s API Partner Program visit DriveAutoHook.com/Partners.

VDP Views are the Top KPI…and Other Data Myths

by David Metter

MYTH #1: VDP views are the metric that matters most.

Since when did VDP views become more important than sales? This is not an attempt to downplay the importance of driving traffic to your VDPs. Reputable evidence exists around VDPs being one of the last digital destinations car shoppers touch before visiting a showroom. But are vehicle details page views receiving significantly more attention than they deserve? Are dealers working backwards? Are we losing sight of our one true goal…to sell more cars?

There’s no argument that with everything our industry is capable of measuring, it all comes down to physical transactions between customers and dealers, specifically units sold and closed service ROs. That’s what you measure before anything else. That’s the reason “big data” exists in the first place – to help you generate more sales and service revenue. Dealers have more data at their fingertips than they realize, and it’s easy to get caught up trying to navigate and make sense of it all. Goals become blurred and dealers lose sight of the end game.

Allow me to remind you of the end game. When it comes to dealership operations, NOTHING is more important than increasing sales, service revenue, and customer retention – and I’m happy to take on anyone who’d like to challenge that statement.

I think our industry has completely overcomplicated the idea of big data. The role it plays is actually quite simple. When you break it down, VDP views are #5 on the “what to measure” list. Below is the infrastructure of the order in which you achieve your end game of more sales, closed service ROs, and repeat buyers.

1. Sales Data: Securing accurate and timely sales match data is paramount. There is nothing more important. Leverage sales match data to see if a customer bought from you or somewhere else? What make and model did they choose? Was it your brand or a competitor’s brand? Monitor your pump in and pump out percent to hold onto sales in your PMA.

2. Service Data: Measure your closed service repair orders – especially during the critical period from after a sale to the first recommended service appointment. This is where most dealers experience the biggest drop off in retention. Did the customer come to your store for their vehicle’s initial scheduled maintenance or to a competitor? Did they order replacement parts from you or somewhere else? How many people made a service appointment on your website? How many of those people actually showed up? What sales opportunities exist among your service customers?

3. Showroom & Service Traffic: Next quantify, how many people physically came into your store or entered your service lane? The majority of people don’t have time to browse around multiple dealerships or visit your service center just for a quote. If they came to you, it’s for a reason. So make sure your staff is in the business of closing deals and ROs.

4. Leads, Phone Calls, & Chats: When potential customers complete an action on your website, whether it’s submitting a lead form or picking up the phone to call you, that opens the door to potential sales. Metrics on your lead, call, and chat volumes are important to analyze, but it’s much more about quality than quantity. Instead of focusing your budget on more leads, calls and chats, focus on the actions that drive showroom visits.

5. VDP Traffic: VDP views drive awareness, familiarity, and consideration. Although they can influence a customer to take further action, they do not directly result in sales.

MYTH #2: VDP traffic is the foundation for future sales.

In what world does a VDP view hold more value than an actual human-to-human interaction? VDP views are not the foundation. Showroom traffic is. Correct me if I’m wrong, but last time I checked, getting people in the door and speaking to them face-to-face is the best way to get them in a vehicle so they can touch, see, feel, drive and experience it for themselves. Show rates are infinitely more impactful than any ad or page view could ever be. Our industry has become so brainwashed, people believe more time, energy, and money should be allocated to driving VDP views rather than using those resources to drive showroom traffic. It’s absolutely mind-boggling.

MYTH #3: Big data is very complex and requires experts to turn it into action.

Wrong. All too often, dealers allow outside vendors to come in and tell them what they should be measuring. Social marketers will tell you social metrics are most important. Paid search companies will tell you clicks and website traffic are the secret to more sales. Our industry is stuck in this maze of listening to incessant digital noise. But every dealership is different, and there is no one size fits all solution.

My friends, it’s time to remove yourself from the maze and turn the volume of the noise ALLLL the way down so that you can actually hear the music.

You and your staff are the ONLY people that should dictate what you need to measure. Take the data you already have and zero in on the metrics that involve sales, service ROs, and repeat customers. Data is simply a catalyst for determining and reaching your goals. Sales data shows you where you stand against competitors, but more importantly, how you stand against yourself historically. Sales data will tell you exactly where you are, and exactly where you need to go.

What You Need to Know About DMPs

by David Metter

DMPs are a topic gaining escalating attention as we head into 2017. A dark cloud of big, irrelevant data still lingers above the automotive industry, just waiting to be analyzed. What are DMPs? For those of you that don’t know, the acronym stands for Data Management Platforms. Think of a DMP as a digital warehouse of data, designed to consolidate and organize consumer data from multiple sources all in one place so that it can be put to good use.

eMarketer addressed the need for advertisers to utilize DMPs back in 2013 – a near decade ago in digital time. “If data is digital marketing’s currency, then the DMP is its bank.” So, when it comes down to whether or not to use DMPs either at the dealer or manufacturer level, really dig deep and ask yourself… do you like money?

If the answer is yes, DMPs exist to give you insights that will help you make more and save more (money that is). DMPs consolidate past and real-time consumer purchase and behavioral data across ad exchanges, networks and devices. This allows for granular audience segmentation and targeting that goes far beyond standard demographics.

DMPs aren’t just a place to aggregate and store information. They help us find the most important data points that will actually help our business. And I don’t mean help down the line or months from now, but this very second. DMPs empower us to take action and deploy personalized campaigns with quantifiable conviction. These platforms are the secret to affirming what every advertiser claims they will do, which of course is to “place the right ad, in front of the right consumer, at the right time.” Sound familiar? Without DMPs, these empty promises would remain just that - empty and unproven.

DMPs are the ultimate source of budgetary efficiency for both digital and traditional spending. By illuminating a clean, 360-degree view of a consumer’s online and offline actions, DMPs pinpoint how far along car shoppers are in the buying process. They identify who in the market has already purchased a vehicle and if they bought it from a competitive dealership or brand. On the contrary, they show which consumers are just beginning their research journey, still months away from a buying decision.

Put simply, DMPs hold your campaigns accountable for their performance and help to guide your ongoing efforts to be more relevant, impactful, and efficient with where you spend your money and who you spend your money on. Specifically for the automotive sector, DMPs may be the solution to a lot of our sales attribution problems. Everyone wants to stake claim for a vehicle sold. A DMP may be just what we need to properly assign credit where credit’s due.

When asked about DMPs, Erik Lukas, Retail Operations Manager of Subaru of America said, “If there’s ever any hope of attributing all these touch points along the shopping journey, you’ve got to have some place where all the data rolls up and you can analyze it as one set.” Aside from attribution, another much-needed use for DMP-derived insights would be for one-to-one marketing and campaign personalization. Both are becoming increasingly necessary in order for a message to stand out and resonate with car shoppers.

According to MarTech Today, “A DMP offers a central location for marketers to access and manage data like mobile identifiers and cookie IDs to create targeting segments for their digital advertising campaigns.” This is a tremendous asset for automakers when it comes to eliminating waste. For example, if you are a luxury vehicle manufacturer, DMPs can help you only target individuals or households that you know have a net income of at least $200,000 per year.

In summary, the biggest uses for DMPs in the auto industry include:

- More accurate sales attribution

- More opportunities for personalization and one-to-one marketing

- Ideal audience targeting and segmentation

Data management platforms are about unification – unifying consumer data from one source to the next as their shopping journey becomes more and more complex. Big data fails to hold value unless it can be applied to better influence your most lucrative audience segment. Other industries have been using DMPs for years. Automotive has such a complex business model given our three-tier system and the fact that most transactions happen offline. Therefore, we need DMPs more than anyone.

The opportunities DMPs provide are limitless. But don’t get too wrapped up in all the ways you could use them to your advantage. Remember your one objective at the end of the day is to increase dealership revenue by selling more units and obtaining more ROs. Above all, SALES is the metric that matters and DMPs should be used primarily to generate more sales. Everything else is just noise.

10 Most Memorable Quotes from the J.D. Power Automotive Marketing Roundtable

The 11th Annual J.D. Power Automotive Marketing Roundtable

AutoHook was honored to attend the 2016 J.D. Power Automotive Marketing routable at the Bellagio, Las Vegas. From Tuesday, October 25th - Thursday, October 27th, we had the privilege of networking with some of the most brilliant leaders in our industry. Things can get a little chaotic between fast-paced sessions and panel discussions, meetings, parties, and catching up with all our friends, clients, and partners.

We've taken the liberty to bring you the 10 very best, most memorable quotes of 2016 - straight from the mouths of automotive's smartest minds themselves.

1. “Don’t start with the big data, start with the business needs first. Identify them and then work backwards. I hear too much of let’s get big data let’s get DMPs in the room, but we need to start with the business needs first.”

- Dean Evans | Chief Marketing Officer, Hyundai Motor America

2. “If there’s ever any hope of attributing all these touch points along the shopping journey, you’ve got to have some place where all the data rolls up and you can analyze it as one set.”

- Erik Lukas | Retail Digital Operations Manager, Subaru of America

3. “There’s no silver bullet when it comes to KPIs. Big Data has become a muse for creativity.”

- Trace Przybylowicz | Autos Lead: Industry Relations, Facebook

4. “The challenge for tier 3 in this big data game is getting some team spirit going where dealers will actually share with the OE and the OE will share with the dealers, and then you’ve got really powerful stuff you can use. Then you can really start to understand who your consumer is and what their actions are.”

- Kelly McNearney | Senior Automotive Retail Strategist, Google

5. “A discussion that seems to be both prevalent and imminent is around DMPs. Data management platforms are almost replacing that ‘big data’ term.”

- David Metter | President, AutoHook powered by Urban Science

6. “A DMP can really give you a full view of who your customer is and how to personalize that experience – that’s the holy grail – making sure your marketing investments are put in the right place.”

- Jenny Watson | Digital & Performance Marketing Expert

7. “Because everyone is online shopping at the dealer’s site, the dealers have a wealth, almost a paralyzing wealth of information. Using that to understand and to empower their marketing - online marketing efforts in particular - can make them much more efficient and vastly more powerful in what they do.”

- Jason Knight | COO & Co-Founder, Lotlinx

8. “Unfortunately too many businesses today do focus just on the transaction and not the experience. We assume people don’t want to be there so we treat them that way. The truth is, people don’t come back if it’s not a great experience. If it’s just a transaction, how is that a great experience?”

- Beau Boeckmann | President, Galpin Motors

9. “With big data comes big challenges in verifying consumer data. We need free from fraud, viewable consumer content and data.”

- Mark Pearlstein | Chief Revenue Officer, DoubleVerify

10. “55% of advertisers consider themselves beginners in mobile advertising – that’s alarming.”

- Christian Fuller | Chief Relationship Officer, Search Optics

Pictured (left to right): Dean Evans, Kelly McNearney, Erik Lukas, Jenny Watson

Pictured: Christian Fuller

Pictured: Beau Boeckmann

Pictured (left to right): Joe Gumm, Bert Boeckmann, Beau Boeckmann, and Bridget Fitzpatrick

Pictured (left to right): Jeremy Anspach, Trace Przybylowicz, Myles Rose, Miran Maric

Pictured (left to right): Andy Jacobson, Kamakshi Sivaramakrishnan, and Mark Pearlstein

Pictured (left to right): Dean Evans, Kelly McNearney, Erik Lukas, Jenny Watson, & David Metter

Pictured (left to right): Jenny Watson and David Metter

NOW OPEN: The Automotive App Store

The Open App Approach to Uniting an Industry

by David Metter

What makes the Apple brand indestructible? There are a million answers to this question, and all are valid. Is Apple’s technology more advanced than Google’s? Not necessarily. Are their smartphones more intelligent than all other smartphones? Probably not. But no one can dispute the fact that they are the simplest devices to navigate for the vast majority of the population. Apple products dominate the market because they’re easy to use, and they integrate flawlessly with one another through Apple’s iCloud.

When we take a step back from the entire culture Apple has created, and strip down every product they’ve reinvented, we start to see the roots of what made them so successful in the first place. We see The App Store, and through that we see unification. We see both integration and alliances. We see the reason people feel naked without their iPhones. The iPhone is so integral to its owner because it makes their lives easier and better. We feel helpless without them. The App Store puts the power in our hands to access tools that improve the way we function on a day-to-day basis. It puts the world at our fingertips, and so many of the best apps out there are free.

Take Waze for example. It is the largest community-based, interactive traffic and navigation app in existence. Its value comes entirely from its users and the information these users provide in real-time. The technology then works by aggregating and building upon its user data to calculate the most efficient route from point A to point B, saving drivers both time and money (again, in real-time). In so many ways (no pun intended), Waze created a more efficient rail system of data that benefits everyone on the road.

What if the automotive industry could create this same type of unified data railroad? What if we knocked down our walls and opened up our own Automotive App Store… free of charge? What if every vendor, dealer, and OEM had faster, more accurate data? What could we accomplish as a community rather than as competitors? CDK Global has already adopted this open app approach when they announced their new Partner Program in September, in efforts to create an ecosystem of approved vendors and applications that can be flawlessly integrated into a CDK dealer website. Could it be? Vendors actually working together to reap the benefits of the bigger picture?

I’ve been fortunate enough to be on both sites of the battle. During my time as CMO at MileOne Automotive, one of our biggest struggles was getting vendors to integrate and work properly together. However, our biggest strength was having the insight to see the unique benefits of two different companies and the means to bring them together in a way that benefitted us and helped us sell more cars. Now that I’m on the vendor side, I’ve seen a need for these types of partnerships to happen now more than ever.

In the short time AutoHook has been in business, we have solidified more partnerships and relationships than anyone else in the space. So, we’re putting our money where our mouth is for the benefit of the entire automotive industry. We know dealers suffer when vendors don’t work together. When dealers and OEMs suffer, vendors also suffer. So let’s change that, shall we?

AutoHook is doing our part to build one, solidified automotive railroad system by opening our API, and the sales validation data that comes with it, to all vendors – free of charge. In an industry where everyone charges to be connected, we want to be the player not to charge so that we can make stronger connections.

By adopting Apple’s open app approach, we can then simplify and unravel a very complicated subject. A subject that is perhaps the one absolute in an industry inundated with ambiguous topics like “big data” and “attribution.” Backed by near-real-time sales data from Urban Science, AutoHook has actually built an attribution engine that validates without a doubt that our solutions led directly to a sale. Sharing this type of knowledge is the one thing that could change this industry for the better. Having access to both accurate and up-to-date sales attribution data will make every decision this industry makes smarter, every solution more efficient, and every dollar we spend go further. Now THAT is something to get excited about.

*As featured in AutoSuccess Magazine | October 2016 edition.